Weekly Crypto Market Roundup: Global News (September 1 – September 4, 2025)

Weekly Crypto Market Roundup

Introduction

The cryptocurrency market kicks off September 2025 with cautious optimism, defying historical trends that label this month as a “curse” for digital assets. Bitcoin holds steady around $110,000 despite minor dips, while Ethereum trades near $4,300 amid shifting investor sentiment. The total crypto market capitalization hovers at approximately $4 trillion, marking a modest 1-2% increase in the last 24 hours as of September 4. Traders eye key macro events like U.S. unemployment data on September 5, which could influence Federal Reserve rate decisions. This roundup covers major global developments, from regulatory shifts to institutional inflows, highlighting how the industry adapts to volatility while pushing for mainstream integration.

Market Overview: Prices Stabilize Amid September Volatility

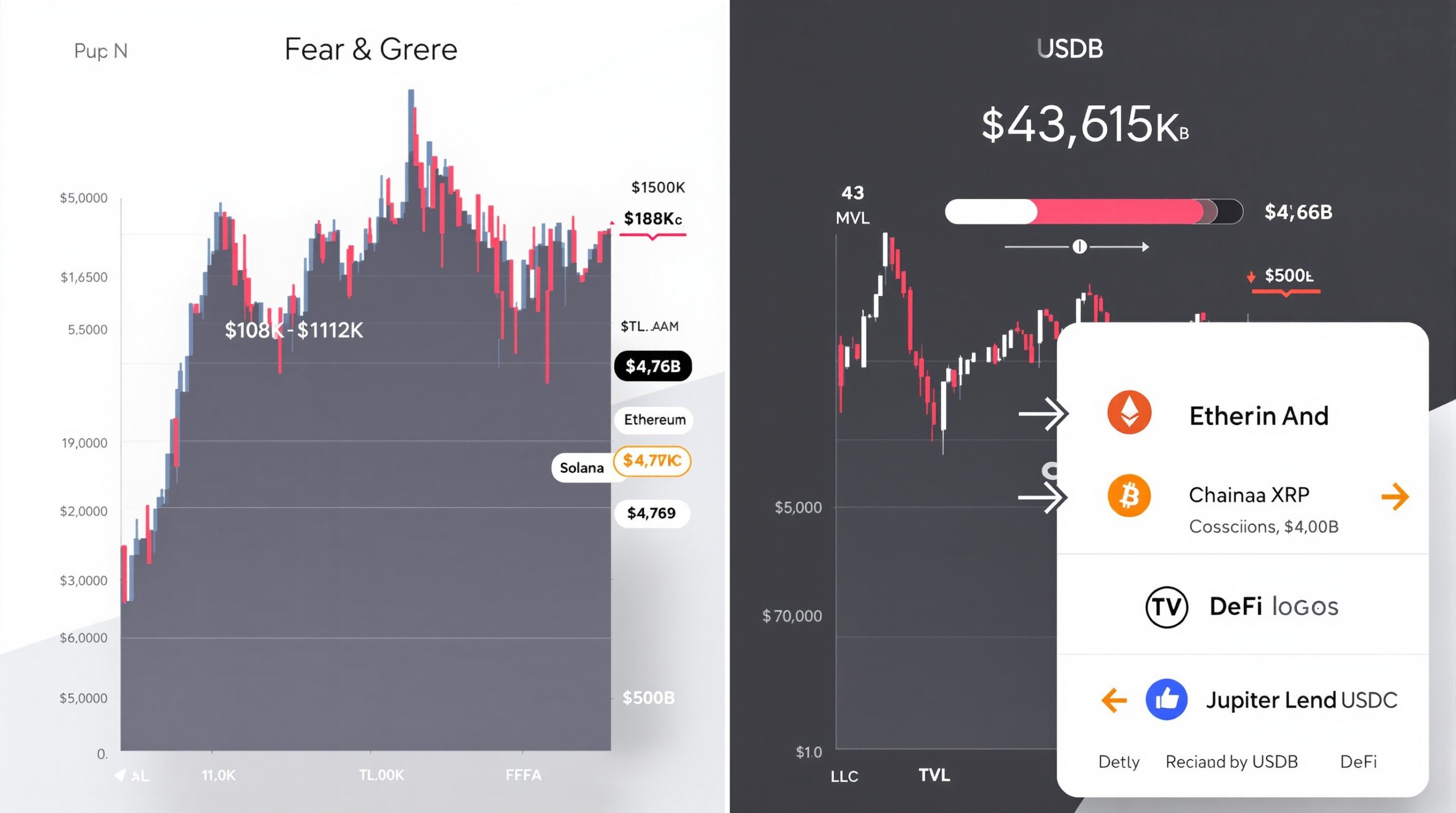

Bitcoin demonstrates resilience this week, trading between $108,000 and $112,000 after a brief pullback from August highs. Analysts attribute this stability to strong ETF inflows, with spot Bitcoin products attracting $748 million last week, offsetting broader market outflows. Ethereum, however, faces downside pressure, dipping to $4,369 on September 4—a 3.19% decline—despite record transaction volumes and institutional interest totaling $1.4 billion in inflows. Altcoins show mixed performance: Solana drops 3.22% to $198.50, XRP falls 2.02% to $2.77, while Chainlink gains modestly amid ETF filings.

The Fear and Greed Index averages 43, signaling caution as Bitcoin dominance slips to 57.4%, allowing liquidity to flow into Ethereum and alternatives. DeFi total value locked (TVL) surpasses $500 billion—a new all-time high—driven by protocols like Jupiter Lend on Solana, which amasses $465 million in TVL in its first week. USDC transfers on Ethereum reach $748 billion in July alone, up 300% year-over-year, underscoring growing utility in payments and stablecoins.

Market participants brace for potential corrections, with historical data showing Bitcoin’s average September return at -3.33%. Yet, optimism persists: Tom Lee predicts an Ethereum rally to $5,000, and analysts forecast altcoin rotations following Bitcoin’s consolidation. External link: For live price data, visit CoinDesk Markets.

Regulatory Developments: U.S. and Global Shifts Accelerate

Regulators worldwide advance frameworks to integrate crypto into traditional finance. In the U.S., the House passes the CLARITY Act, categorizing digital assets and shifting oversight for many tokens to the Commodity Futures Trading Commission (CFTC). This could resolve long-standing uncertainties, with Senate reconciliation expected by late September. The CFTC also outlines paths for offshore exchanges to serve U.S. customers legally, potentially boosting accessibility.

Nasdaq tightens scrutiny on companies raising funds for crypto purchases, amid plans by firms to acquire over $98 billion in digital asset treasuries. Meanwhile, the SEC’s proposed repeal of Staff Accounting Bulletin 121 (SAB 121) eases reporting burdens for crypto custodians, aligning accounting with industry realities. The GENIUS Act proposes strict standards for stablecoin issuers, requiring 1:1 reserves and audits.

Globally, Japan proposes slashing crypto capital gains tax to a flat 20% from up to 55%, reclassifying assets under financial laws to spur adoption. El Salvador enacts an Investment Banking Law, allowing licensed firms to offer Bitcoin services and issue crypto bonds, positioning the nation as a regional hub. External link: Read more on U.S. regulatory updates at CNBC Crypto World.

Institutional Adoption: Banks and Corporates Dive Deeper

Institutions fuel growth with innovative products and integrations. Google Cloud launches the Universal Ledger, providing blockchain rails for banks and enterprises to tokenize assets efficiently. Stripe and Paradigm unveil Tempo, a blockchain for stablecoin payments, aiming to streamline global transactions.

Trump Media Group partners with x.com to manage a $6.42 billion CRO treasury, blending politics with crypto capital. Winklevoss-owned Gemini files for a $317 million IPO on Nasdaq, backed by Goldman Sachs and Citigroup, valuing the exchange at $2.2 billion. ETF filings surge: Bitwise submits for a Chainlink ETF, and 21Shares for SEI, expanding beyond Bitcoin and Ethereum.

Aave introduces Horizon for institutional lending using real-world assets as collateral, while Fireblocks launches a stablecoin payments network. The U.S. government publishes GDP data on a public blockchain via Coinbase and Kraken, marking a milestone in transparent economic reporting. External link: Explore institutional trends at Forbes Advisor Crypto.

Technological Advancements: DeFi, AI, and Gaming Evolve

Innovation drives the sector forward. Hyperliquid briefly surpasses Binance in Bitcoin spot volume, highlighting emerging challengers. Starknet’s v0.14.0 upgrade introduces decentralized sequencing, enhancing scalability. The Ethereum Foundation releases an L2 interoperability framework, and the Ethereum Community Foundation launches BETH, a token representing burned ETH for provable scarcity.

In DeFi, 99% of Hyperliquid fees will fund buybacks post-upgrade, and Liquity Protocol’s BOLD launches on Hyperliquid EVM with Curve pools. AI tokens gain traction, with market value exceeding $36 billion; Bittensor sees search interest spike 281%. GameFi advances: Animoca Brands acquires full control of The Sandbox for a metaverse reboot, and Pudgy Penguins debuts “Pudgy Party” mobile game. Helium Mobile achieves record user growth.

Tokenization trends accelerate: Seazen (China) plans to tokenize IP and property, while VCI Global launches RWA lounges with NFTs. Central Bank Digital Currencies (CBDCs) progress in 132 countries, representing 98% of global GDP. External link: Dive into blockchain tech at CoinDesk.

Notable Funding and Launches: Capital Flows In

Venture funding remains robust: aPriori raises $20 million for on-chain HFT, Hemi secures $15 million for BTC-ETH L2, and M^0 nets $40 million for stablecoin infrastructure. Rain bags $58 million for stablecoin payments, and The Clearing Co gets $15 million for prediction markets.

Launches include WLFI trading on DEXs like Uniswap and Raydium, Portal to Bitcoin’s PTB token on September 3, and Somnia Network’s SOMI TGE. Token unlocks add pressure: SUI ($153 million), Ethena ($25.6 million), and others on September 1-7. Gemini’s XRP Credit Card tops finance apps with cashback rewards. External link: Track funding news at Crypto.News.

Security and Risks: Hacks Persist, Responses Improve

Cyber threats loom large, with 2025 hack losses exceeding $2 billion. Uniswap v4 DEX Bunni suffers an $8.4 million exploit via liquidity vulnerabilities, prompting contract pauses and bounties. Venus Protocol liquidates a hacker’s account after a $13 million breach, showcasing community-driven defenses.

Exchanges enhance safeguards: Proof-of-reserves and audits gain traction. Binance halts USDT/USDC perpetual futures trading abruptly, citing compliance. External link: Stay updated on security at The Block.

Regional Highlights: Asia Leads Innovation

Asia emerges as a hotspot: China’s Seazen establishes a Digital Assets Institute in Hong Kong for tokenization. Japan’s JPYC launches the first regulated yen stablecoin later in 2025. In Europe, London’s $900 billion gold market shifts on-chain. Avalanche transactions surge 66% after U.S. GDP on-chain data. External link: Regional insights at BeInCrypto.

Conclusion

September 1-4, 2025, showcases crypto’s maturation: Regulatory clarity fosters trust, institutional tools drive adoption, and innovations like tokenization promise real-world impact. While volatility persists—evident in price dips and unlocks—the sector’s liquidity, TVL highs, and funding inflows signal strength. Investors should monitor U.S. jobs data and Fed signals for short-term cues, but long-term trends point to growth. As Bitcoin defies the “curse” and Ethereum eyes upside, the global market positions for a transformative era.