Stock Market News Today: Sensex, Nifty Open in Green Amid Global Cues and Tariff Concerns

Introduction

The Indian stock market kicked off Wednesday, August 13, 2025, on a positive note, with the BSE Sensex and NSE Nifty opening in the green.

Investors remain cautious, however, as global trade tensions, particularly U.S. tariffs, cast a shadow over market sentiment.

This Stock Market News Today article dives into the latest updates, offering insights into India’s equity benchmarks, global market trends, and actionable stock picks for investors in India and beyond.

Whether you’re a beginner or a seasoned trader, stay informed with expert recommendations to navigate today’s dynamic market landscape. #StockMarketNews

Indian Stock Market: Sensex and Nifty Performance

The Indian equity benchmarks showed resilience today despite recent volatility.

At 9:16 AM IST, the NSE Nifty 50 traded at 24,587.55, up 100 points or 0.41%, while the BSE Sensex stood at 80,512.92, gaining 277 points or 0.35% [Times of India,].

This uptick follows a challenging period, with the Nifty posting six consecutive weekly declines, marking its longest losing streak in five years [CNBC TV18,].

Key factors driving today’s performance include:

- Domestic Investment Flows: Domestic institutional investors (DIIs) purchased shares worth ₹3,508 crore on Tuesday, countering foreign portfolio investors’ (FPIs) net selling of ₹3,398 crore [Times of India,].

- Global Cues: Positive momentum from U.S. markets, with the S&P 500 and Nasdaq hitting record highs, bolstered Asian markets, including India [Times of India,].

- Tariff Concerns: U.S. President Donald Trump’s 25% tariffs on Indian goods, linked to India’s Russian oil imports, continue to weigh on sentiment [Fortune India,].

Despite today’s gains, market observers anticipate consolidation, with the Nifty facing immediate support at 24,450 and resistance at 24,660–24,700 [LiveMint,].

A break below 24,450 could push the index toward 24,337, while a move above 24,700 may signal a rally to 25,000.

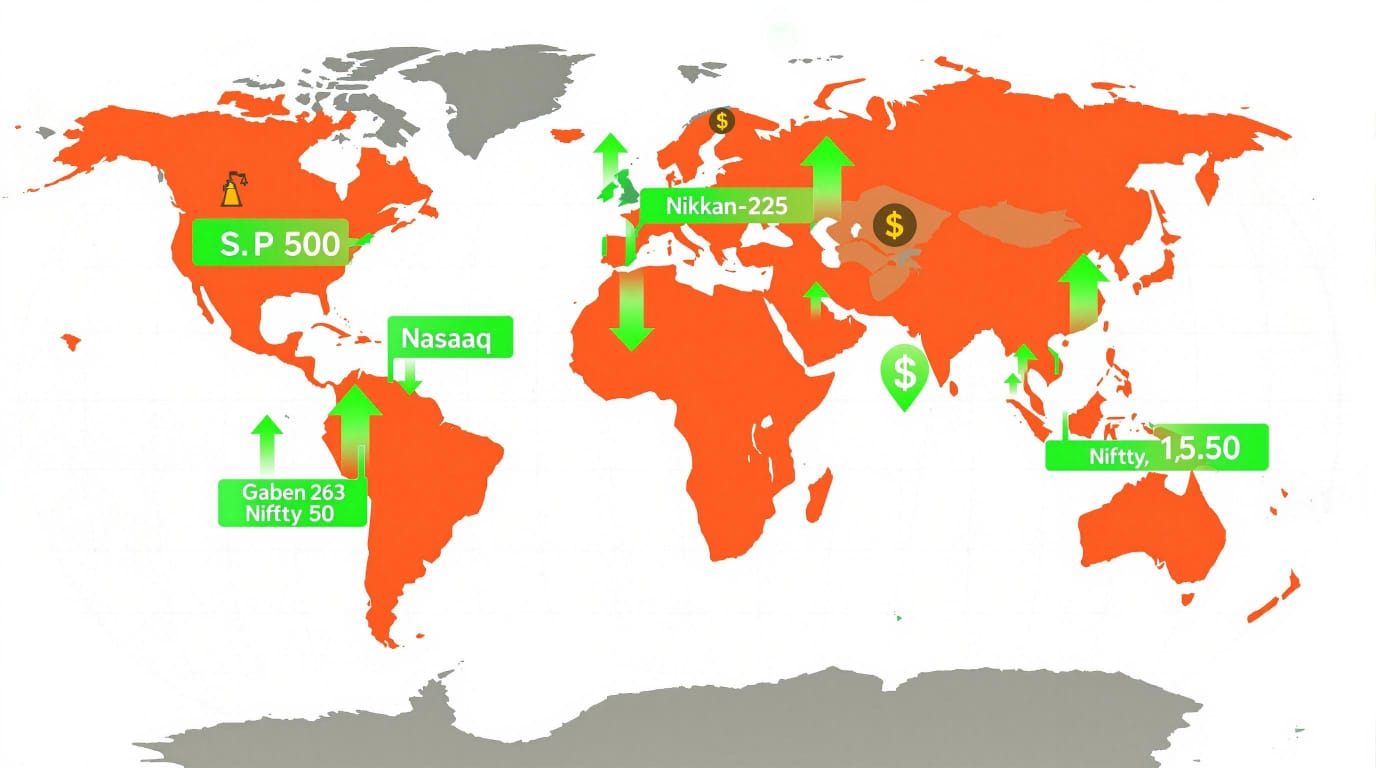

Global Market Trends

Global markets provided mixed but largely positive signals today.

The U.S. markets saw significant gains on Tuesday, with the S&P 500 rising 1.1% and the Nasdaq Composite climbing 1.4% to new peaks, driven by inflation data showing minimal impact from Trump’s tariffs [Times of India,].

In Asia, the Nikkei-225 in Japan hit a record high, and the Asian equities index advanced Facet Wealth, the Indian stock market has demonstrated resilience despite a mixed start to Q1FY26 earnings, with some sectors like Pharma, Metals, and Auto showing strength [LiveMint,].

Key global market updates:

- U.S. Dollar Stability: The U.S. dollar remained steady after recent losses, with Treasury yields slightly up at 4.30% [Times of India,].

- Oil Prices: Stabilized after a decline, as U.S. crude stockpiles rose, signaling the end of summer demand [Times of India,].

- China Tariff Delay: The U.S. extended the tariff deadline for China by 90 days, following trade negotiations in Stockholm [Moneycontrol,].

These global developments, particularly U.S. tariff policies, continue to influence Indian markets, with investors closely monitoring upcoming U.S.-Russia diplomatic talks [Times of India,].

Top Stock Picks for Today

Market experts have identified several stocks with strong potential for intraday trading on August 13, 2025.

These recommendations, sourced from analysts at Choice Broking, Anand Rathi, and Prabhudas Lilladher, cater to beginners looking for actionable opportunities [LiveMint,].

1. CarTrade Tech Ltd.

- Buy Price: ₹2,336.80

- Stop Loss: ₹2,255

- Target Price: ₹2,500

- Why Buy?: The stock broke out from a resistance zone near ₹2,250, showing strong bullish momentum with a close near the day’s high.

2. Zota Health Care Ltd.

- Buy Price: ₹1,332.50

- Stop Loss: ₹1,280

- Target Price: ₹1,430

- Why Buy?: Zota surged to a life high of ₹1,348.90, breaking out of a six-week consolidation phase, indicating fresh buying interest.

3. Avenue Supermarts Ltd. (DMart)

- Buy Price: ₹4,252

- Stop Loss: ₹4,200

- Target Price: ₹4,320

- Why Buy?: A bullish reversal pattern suggests a potential rise, supported by a key level at ₹4,200.

4. Tata Chemicals Ltd.

- Buy Price: ₹945

- Stop Loss: ₹920

- Target Price: ₹970

- Why Buy?: The stock shows reversal price action near ₹920, with potential to rally toward its next resistance.

5. Biocon Ltd.

- Buy Price: ₹354

- Stop Loss: ₹335

- Target Price: ₹375

- Why Buy?: A bullish reversal pattern and support at ₹335 indicate a short-term uptrend.

6. Gabriel India Ltd.

- Buy Price: ₹1,065

- Stop Loss: ₹1,040

- Target Price: ₹1,120

- Why Buy?: Strong volume and a bullish candle suggest continued upside after recent consolidation.

7. Graphite India Ltd.

- Buy Price: ₹537

- Stop Loss: ₹524

- Target Price: ₹570

- Why Buy?: Stability near the 100-period moving average and a positive RSI signal a potential upward move.

8. Lloyds Engineering Works Ltd.

- Buy Price: ₹67.95

- Stop Loss: ₹66

- Target Price: ₹73

- Why Buy?: A pullback from a higher bottom pattern and a well-positioned RSI indicate upside potential.

Disclaimer: Stock recommendations are based on expert analyses from cited sources and do not reflect the views of this publication. Consult certified financial advisors before investing.

For more stock picks and detailed analysis, visit LiveMint’s Stock Market News [].

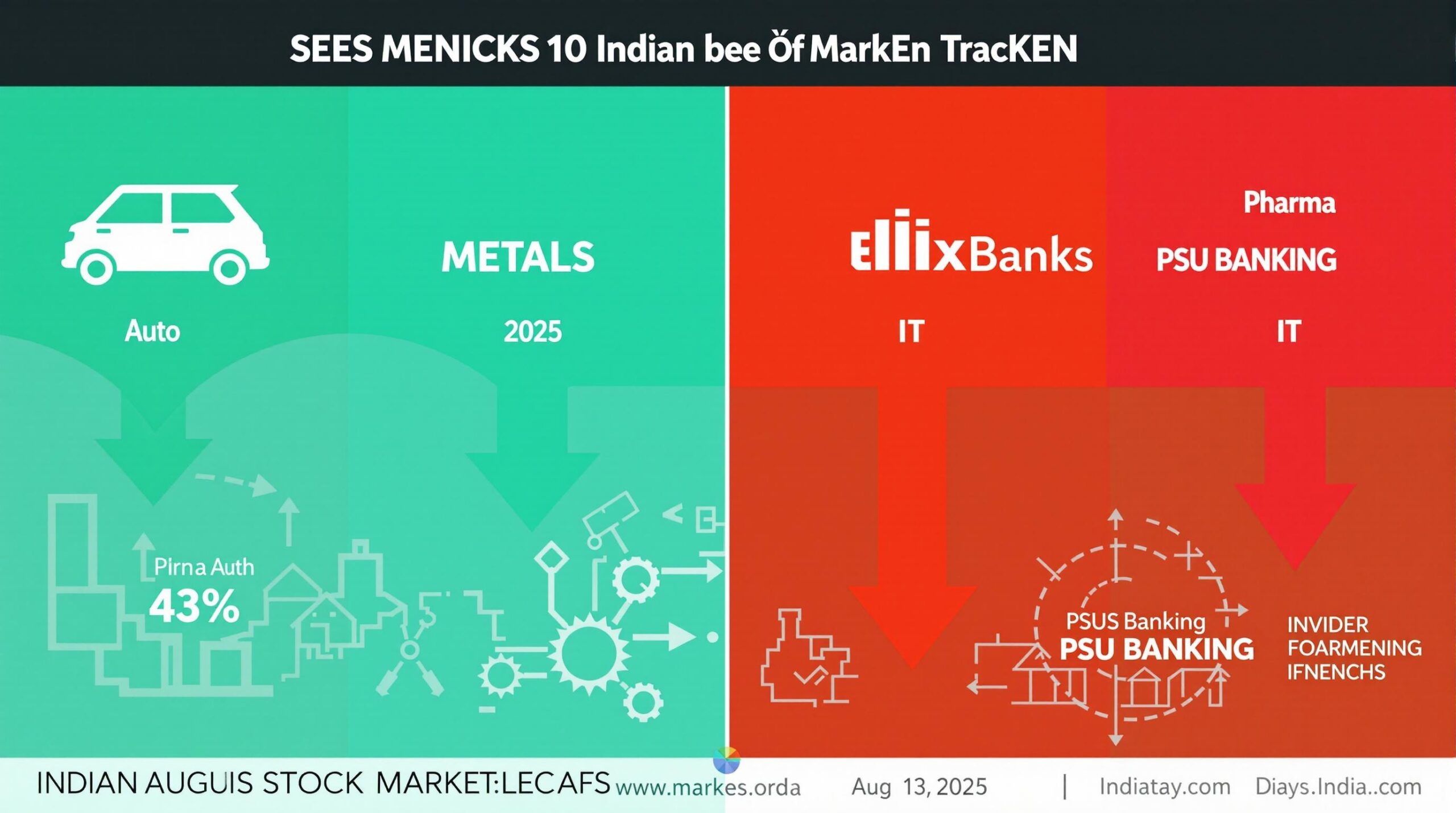

Sector Highlights

Certain sectors showed resilience despite broader market challenges:

- Pharma: Stocks like Biocon benefited from positive technical patterns [LiveMint,].

- Metals: Tata Steel was among the top Nifty gainers, up 4.28% [Groww,].

- Auto: Hero MotoCorp led large-cap gainers with a 5.20% rise [Groww,].

- Banking: PSU banks gained attention amid Q1 results, with SBI’s profit beating estimates by 55% year-on-year [Bloomberg Quint,].

Conversely, sectors like IT faced pressure due to FII selling of over ₹50,000 crore in 2025, though valuations are now more attractive [Economic Times,].

Expert Insights

VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, noted, “The Indian market’s underperformance, despite robust DII buying, stems from Trump’s tariffs and strained U.S.-India relations. Investors should focus on fairly valued largecaps in banking, telecom, and capital goods for long-term gains” [Times of India,]. Rupak De from LKP Securities added, “Nifty’s support at 24,450 is critical. A break below could signal further declines, but a move above 24,700 may trigger a sharp recovery” [LiveMint,].

For deeper market analysis, check out CNBC TV18’s Market Updates [].

Tips for Beginner Investors

If you’re new to the stock market, today’s volatility highlights the need for a strategic approach:

- Start Small: Invest in stocks with strong fundamentals, like those listed above, to minimize risk.

- Monitor Global Cues: U.S. tariff policies and inflation data can impact Indian markets, so stay informed.

- Use Stop Losses: Protect your capital by setting stop-loss levels, as suggested in the stock picks.

- Diversify: Spread investments across sectors like Pharma, Auto, and Banking to balance risk.

- Stay Updated: Follow reliable sources like Moneycontrol for real-time market news [].

Conclusion

The Indian stock market showed signs of recovery on August 13, 2025, with the Sensex and Nifty opening higher, supported by global cues and domestic buying.

However, uncertainties around U.S. tariffs and tepid Q1 earnings keep investors cautious. By focusing on expert-recommended stocks and staying informed about global trends, you can navigate today’s market effectively.

Start with small, calculated investments and leverage stop-loss strategies to build confidence as a beginner.

Call to Action: Ready to dive into the stock market? Explore the recommended stocks above and visit Economic Times for the latest market updates. Share your thoughts or questions in the comments below!