Gold Price Today in India: 10 Essential Insights for Smart Investors

Gold Price Today in India Essential Insights

Introduction

Gold holds a special place in India, symbolizing wealth, tradition, and security. Whether you’re planning to buy jewelry for a wedding, invest in gold coins, or explore digital gold, staying updated on today’s gold price is crucial. As of August 25, 2025, gold prices in India reflect global trends, local demand, and economic factors. This article provides a comprehensive listicle with a detailed table of current gold prices, expert insights, and actionable tips to help Indian investors and buyers make informed decisions. Follow these 10 essential points to understand today’s gold market and optimize your investments.

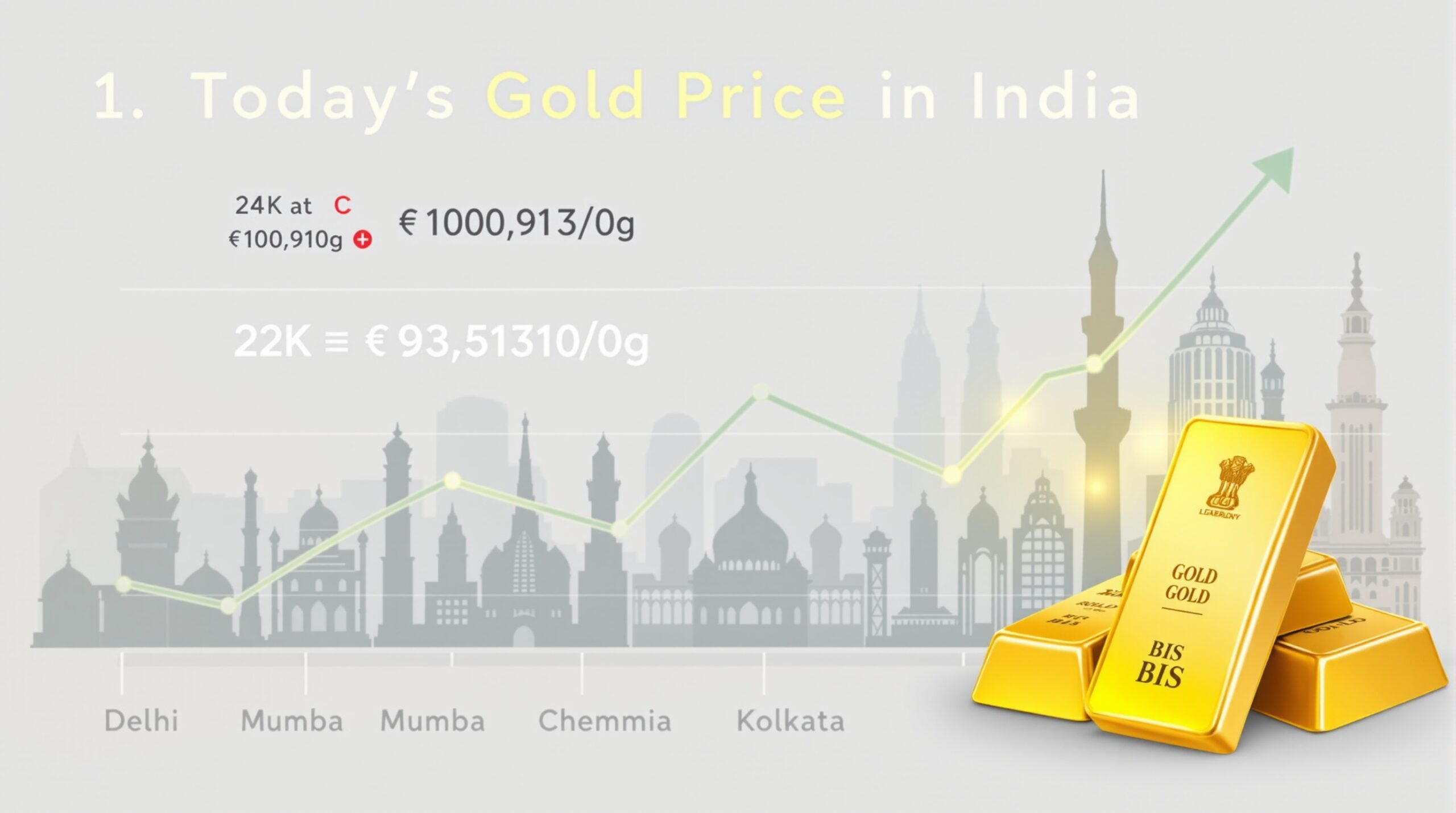

1. Today’s Gold Price in India: A Snapshot

Gold prices in India fluctuate daily due to global market dynamics and local factors. As of August 25, 2025, the average price for 24K gold is approximately ₹10,198.93 per gram, while 22K gold stands at ₹9,342.22 per gram, according to reliable sources like Gold Price Data. Below is a detailed table showcasing today’s gold prices for 22K and 24K gold across major Indian cities.

| City | 22K Gold (₹/10g) | 24K Gold (₹/10g) |

|---|---|---|

| Delhi | 93,513.00 | 100,913.00 |

| Mumbai | 93,367.00 | 100,767.00 |

| Chennai | 93,361.00 | 100,761.00 |

| Kolkata | 93,365.00 | 100,765.00 |

| Bangalore | 93,355.00 | 100,755.00 |

| Hyderabad | 93,230.00 | 100,075.00 |

| Pune | 93,373.00 | 100,773.00 |

| Ahmedabad | 93,334.00 | 100,080.00 |

Source: Live Mint Gold Rates, Gold Price Data

Note: Prices may vary slightly due to local taxes, making charges, and jeweler margins. Always verify rates with trusted jewelers or platforms like Joyalukkas for real-time updates.

2. Why Gold Prices Fluctuate Daily

Gold prices in India respond to a mix of global and local influences. International factors, such as the US dollar exchange rate and geopolitical events, drive price changes. A weaker Indian Rupee against the USD often increases gold prices. Locally, demand spikes during festivals like Diwali or wedding seasons push prices higher. For instance, import duties (currently 15%) and GST (3% on gold, 5% on making charges) also impact costs, as noted by Angel One.

3. Understanding 22K vs. 24K Gold

Choosing between 22K and 24K gold depends on your purpose.

- 24K Gold: 99.9% pure, ideal for investment in coins or bars due to its high value.

- 22K Gold: 91.6% pure, mixed with alloys for durability, perfect for jewelry.

For daily wear, 22K gold offers a balance of beauty and strength, while 24K suits long-term investments. Check purity with BIS hallmark certification for authenticity.

4. Gold Price Trends in August 2025

Recent data shows gold prices in India have risen steadily. From ₹97,423.00 per 10 grams in June to ₹100,913.00 by August 20, 2025, 24K gold has seen a 3.59% increase since January, according to Live Mint. This upward trend reflects global economic uncertainty and strong domestic demand.

5. City-Wise Price Variations

Gold prices vary across Indian cities due to local taxes, transportation costs, and jeweler margins. For example, Delhi’s 24K gold price (₹100,913.00/10g) is slightly higher than Hyderabad’s (₹100,075.00/10g) due to demand differences. Always compare rates across cities using trusted platforms like India Gold Rate.

6. How Gold Prices Are Determined

The Indian Bullion Jewellers Association (IBJA) sets daily gold prices by averaging quotes from major dealers. These rates factor in:

- International Spot Price: Converted to INR using the current exchange rate.

- Import Duties and GST: Adds to the final cost.

- Local Demand: Higher demand in cities like Mumbai increases prices.

For accurate pricing, refer to Economic Times Gold Rate.

7. Investment Options for Gold in India

Gold offers diverse investment avenues:

- Physical Gold: Buy coins, bars, or jewelry from trusted jewelers like Joyalukkas.

- Gold ETFs: Track gold prices without physical storage, available on stock exchanges.

- Sovereign Gold Bonds (SGBs): Government-backed, offering interest and tax benefits.

- Digital Gold: Purchase small amounts via platforms like India Gold.

Each option suits different goals—physical gold for tradition, ETFs for liquidity, and SGBs for long-term returns.

8. Factors Influencing Gold Prices

Several factors drive gold price changes:

- Global Market Trends: Economic uncertainty increases demand for gold as a safe-haven asset.

- Currency Fluctuations: A weaker INR raises gold costs.

- Seasonal Demand: Festivals and weddings boost prices.

- Government Policies: Changes in import duties or taxes affect rates.

Stay informed via Hindustan Times Gold Updates.

9. Tips for Buying Gold in 2025

Maximize your gold purchase with these tips:

- Check Purity: Ensure BIS hallmark certification for authenticity.

- Compare Prices: Use platforms like Gold Rate for real-time rates.

- Avoid Peak Seasons: Prices rise during festivals; buy during off-peak times.

- Negotiate Making Charges: These vary (5–15%) and can be bargained.

- Invest Diversely: Combine physical gold with ETFs or SGBs for balanced returns.

10. Why Gold Remains a Smart Investment

Gold’s value endures due to its:

- Inflation Hedge: Preserves purchasing power during economic turbulence.

- Liquidity: Easily sold or traded globally.

- Cultural Significance: A trusted asset for Indian families.

- Portfolio Diversification: Balances risk with low correlation to stocks.

Explore gold savings accounts or digital gold via India Gold for modern investment options.

Conclusion

Today’s gold price in India, as shown in the table, reflects a dynamic market influenced by global and local factors. Whether you’re buying jewelry or investing in gold bonds, understanding these trends empowers you to make smart choices. Use trusted platforms like Times of India Gold Rates for daily updates and consult jewelers for precise pricing. Start your gold journey today with confidence