Gold Price Today in India: September 8, 2025 – Latest Updates, Trends, and Insights

Gold Price Today in India

Introduction: Gold Prices Soar to Record Highs in India

Gold continues to shine as one of India’s most cherished investments, driven by cultural affinity and its role as a hedge against inflation. On September 8, 2025, gold prices in India have surged to unprecedented levels, fueled by global economic shifts, geopolitical tensions, and expectations of a US Federal Reserve rate cut. This article provides a comprehensive update on today’s gold prices across major Indian cities, key factors influencing the market, and expert insights on whether to buy or sell. Stay informed with our detailed analysis and price tables to make smart investment decisions.

Today’s Gold Prices in India: September 8, 2025

Gold prices in India vary slightly across cities due to local taxes, logistics, and jeweler margins. Below is a detailed table showcasing the latest gold rates for 22-carat and 24-carat gold in major Indian cities, as reported by trusted sources like the India Bullion and Jewellers Association (IBJA) and leading financial platforms.

| City | 22 Carat Gold (per 10 grams) | 24 Carat Gold (per 10 grams) | Change from Previous Day |

|---|---|---|---|

| Delhi | ₹99,450 | ₹1,08,370 | +₹800 (22K), +₹650 (24K) |

| Mumbai | ₹99,400 | ₹1,08,320 | +₹780 (22K), +₹630 (24K) |

| Bengaluru | ₹99,420 | ₹1,08,350 | +₹790 (22K), +₹640 (24K) |

| Chennai | ₹99,470 | ₹1,08,400 | +₹810 (22K), +₹660 (24K) |

| Hyderabad | ₹99,430 | ₹1,08,360 | +₹800 (22K), +₹650 (24K) |

| Kolkata | ₹99,460 | ₹1,08,390 | +₹805 (22K), +₹655 (24K) |

Note: Prices are indicative and exclude GST, TCS, and making charges. For exact rates, contact your local jeweler. Source: Goodreturns, LiveMint.

The table reflects a significant uptick in gold prices, with 22-carat gold nearing the ₹1 lakh mark and 24-carat gold surpassing ₹1.08 lakh per 10 grams in most cities. This rally aligns with global trends, where spot gold reached $3,624.44 per troy ounce, up 0.89% from the previous day.

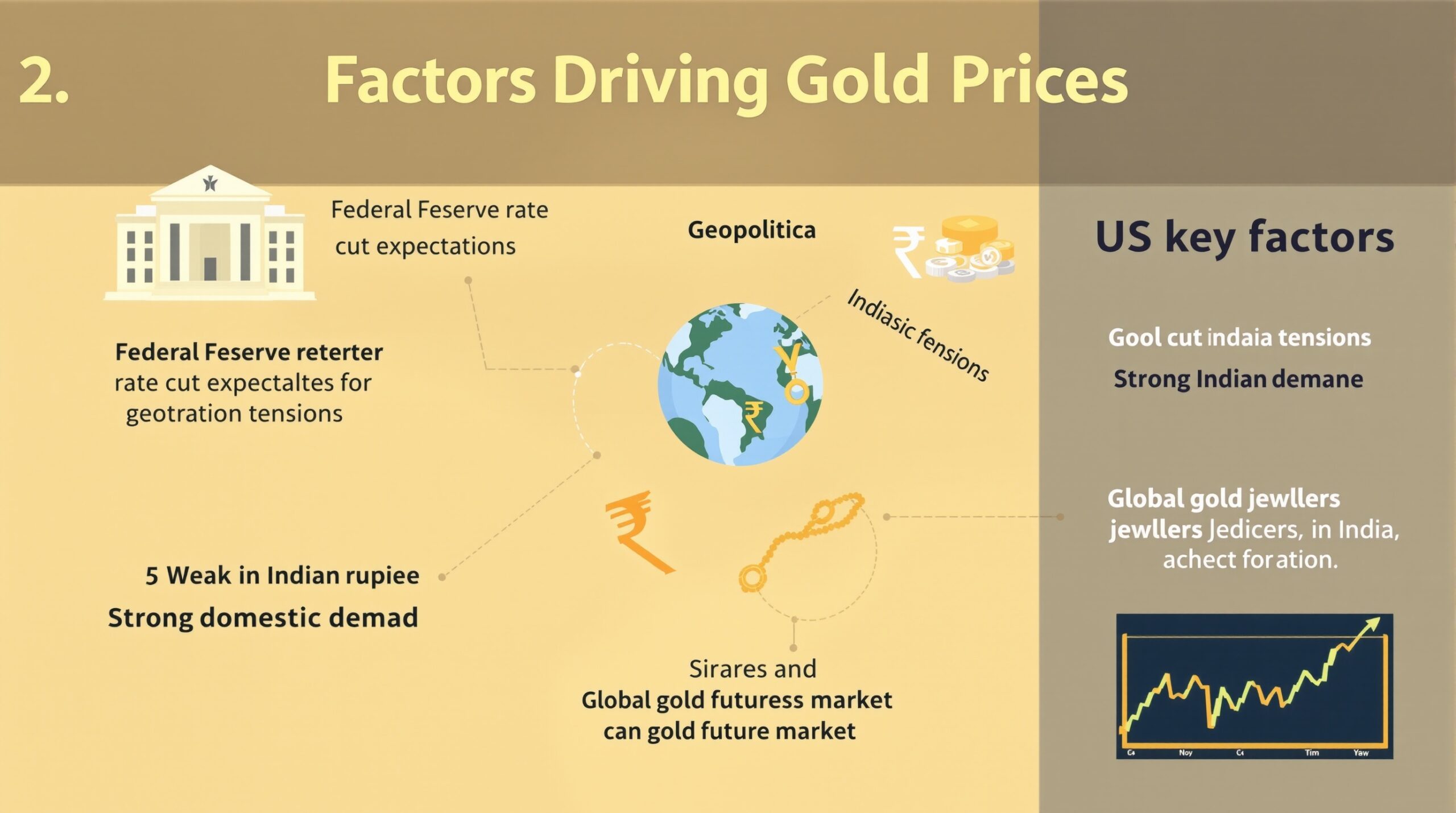

Factors Driving Gold Prices in India Today

Several factors are propelling gold prices to record highs in India. Understanding these dynamics helps investors and buyers make informed decisions.

1. Global Economic Signals and US Federal Reserve Rate Cut Expectations

The anticipation of a US Federal Reserve rate cut in September 2025 has significantly boosted gold’s appeal. Federal Reserve Chairman Jerome Powell’s recent shift in focus from inflation to the US job market has increased the likelihood of lower interest rates, making non-yielding assets like gold more attractive. Experts predict two to three rate cuts by the end of 2025, supporting gold’s bullish outlook.

2. Geopolitical Tensions

Escalating geopolitical uncertainties, including US actions in Venezuela, Israeli strikes in Yemen, and trade tensions between the US and China, have heightened safe-haven demand for gold. Additionally, US President Donald Trump’s proposed 50% tariffs on India, including 25% secondary tariffs, are creating market volatility, further driving investors toward gold.

3. Weak Indian Rupee

The Indian rupee has hit a record low, breaching the 89 mark against the US dollar. A weaker rupee increases the cost of imported gold, pushing domestic prices higher. The Reserve Bank of India (RBI) is closely monitoring the currency’s movement, but the depreciation continues to impact gold rates.

4. Domestic Demand and Cultural Significance

India’s deep-rooted cultural affinity for gold, especially during festive seasons and weddings, sustains strong domestic demand. With the festive season approaching, jewelers are reporting increased inquiries for gold jewelry, further supporting price gains.

5. Global Market Trends

Gold futures on the Multi Commodity Exchange (MCX) are trading near record highs at ₹1,06,539 per 10 grams, reflecting global bullishness. Silver, too, has surged, reaching ₹1,25,249 per kilogram, driven by industrial demand in sectors like solar and electric vehicles (EVs).

Expert Insights: Should You Buy or Sell Gold Today?

Analysts remain optimistic about gold’s near-term outlook, with prices expected to range between ₹99,500 and ₹1,10,000 per 10 grams for the rest of 2025, potentially climbing to ₹1,10,000–₹1,25,000 in the first half of 2026.

- Manav Modi, Senior Analyst at Motilal Oswal Financial Services, suggests that gold prices are likely to remain well-supported unless inflation data drastically alters the Federal Reserve’s rate cut plans. He recommends a “buy on dips” strategy, targeting support levels at ₹1,06,450 and resistance at ₹1,07,260.

- Jateen Trivedi, VP Research Analyst at LKP Securities, notes that gold’s bullish structure is intact as long as prices hold above ₹1,06,150. He advises investors to buy near ₹1,06,500 with a stop-loss at ₹1,06,150.

- Renisha Chainani, Head of Research at Augmont, predicts gold could hit $3,700 (approximately ₹1.10 lakh) in the coming weeks, driven by safe-haven demand and macroeconomic risks. She sees potential for gold to reach $4,000 (approximately ₹1.20 lakh) by the end of 2025.

Investment Strategy

- Buyers: Consider purchasing gold on price dips, especially near the ₹1,06,500 support level, as the long-term outlook remains positive.

- Sellers: Avoid selling unless prices fall below ₹1,06,150, as this could signal short-term weakness. Monitor upcoming US economic data, such as Nonfarm Payrolls and CPI reports, for potential volatility.

Historical Context: Gold Price Trends in India (Last 10 Days)

To provide context, here’s a snapshot of gold price trends for 22-carat and 24-carat gold (per 10 grams) in Delhi over the last 10 days:

| Date | 22 Carat Gold (₹) | 24 Carat Gold (₹) |

|---|---|---|

| September 7, 2025 | 98,650 | 1,07,720 |

| September 6, 2025 | 98,650 | 1,07,720 |

| September 5, 2025 | 98,500 | 1,07,550 |

| September 4, 2025 | 98,400 | 1,07,450 |

| September 3, 2025 | 98,300 | 1,07,350 |

| September 2, 2025 | 98,200 | 1,07,250 |

| September 1, 2025 | 98,100 | 1,07,150 |

| August 31, 2025 | 98,050 | 1,07,100 |

| August 30, 2025 | 98,000 | 1,07,050 |

| August 29, 2025 | 97,950 | 1,07,000 |

Source: Goodreturns.

The steady upward trend reflects gold’s resilience amid global uncertainties and domestic demand.

Why Gold Remains a Top Investment Choice in India

Gold’s enduring appeal in India stems from its dual role as a cultural asset and a financial hedge. Here’s why it continues to attract investors:

- Inflation Hedge: Gold prices remain stable during high inflation, unlike volatile stock market instruments.

- Safe-Haven Asset: Geopolitical and economic uncertainties drive demand for gold as a secure investment.

- Liquidity: Gold is highly liquid, making it easy to buy or sell in various forms, such as jewelry, coins, or bars.

- Cultural Value: Gold’s significance综艺 in weddings, festivals, and gifting ensures consistent demand.

For those considering gold investments, explore options like gold ETFs, sovereign gold bonds, or physical gold, depending on your financial goals. Consult a financial advisor for personalized advice.

Conclusion: Stay Ahead of the Gold Market

Gold prices in India on September 8, 2025, reflect a robust bullish trend, driven by global economic factors, geopolitical tensions, and a weakening rupee. With 22-carat gold nearing ₹1 lakh and 24-carat gold exceeding ₹1.08 lakh per 10 grams, investors and buyers must stay vigilant. Monitor support and resistance levels, upcoming US economic data, and currency movements to make informed decisions. Whether you’re buying for investment or jewelry, gold remains a solid choice in today’s volatile market.

For the latest updates, bookmark trusted sources like Goodreturns and LiveMint. Stay tuned for daily gold price updates and expert insights to navigate this dynamic market.

Disclaimer: Gold prices are subject to change based on market conditions. Always verify rates with local jewelers before making purchases. This article is for informational purposes only and not financial advice.