Weekly Commodities Market India News: August 25, 2025

Weekly Commodities Market India News

Introduction

The Indian commodities market has experienced significant fluctuations this week, driven by global geopolitical developments, domestic demand, and macroeconomic signals.

From gold’s volatility to oil’s response to supply concerns, the market reflects a complex interplay of factors.

This article dives into the latest updates on gold, oil, silver, steel, and agricultural commodities in India, offering insights for traders, investors, and industry enthusiasts. Stay informed with our comprehensive weekly roundup, crafted to keep you ahead in the dynamic commodities landscape.

Gold Prices Face Volatility Amid Global and Domestic Cues

Gold prices in India have been on a rollercoaster, reflecting global uncertainties and domestic demand surges.

On August 22, 2025, gold futures on the Multi Commodity Exchange (MCX) dropped by Rs 304 to Rs 99,000 per 10 grams, marking a weekly decline of Rs 1,200. This follows a broader trend where gold slipped below Rs 1 lakh, trading at Rs 99,860 per 10 grams on August 18, 2025, as easing geopolitical tensions and a stronger U.S. dollar weighed on prices.

Analysts predict further downside, with potential support levels around Rs 97,500, driven by dovish U.S. Federal Reserve cues and ongoing U.S.-Ukraine talks. However, resistance is expected near Rs 1,00,500.

The wedding season in India, a key driver of gold demand, is providing some support. According to Upstox, heightened demand for gold jewellery amid festive preparations could push prices upward in the coming weeks.

Globally, gold hit a near three-week low at $3,318.07 per ounce on August 20, 2025, as investors awaited Federal Reserve Chair Jerome Powell’s Jackson Hole symposium speech for monetary policy clarity.

For Indian investors, gold remains a safe-haven asset, especially with uncertainties like Trump’s tariff threats and the Russia-Ukraine conflict lingering.

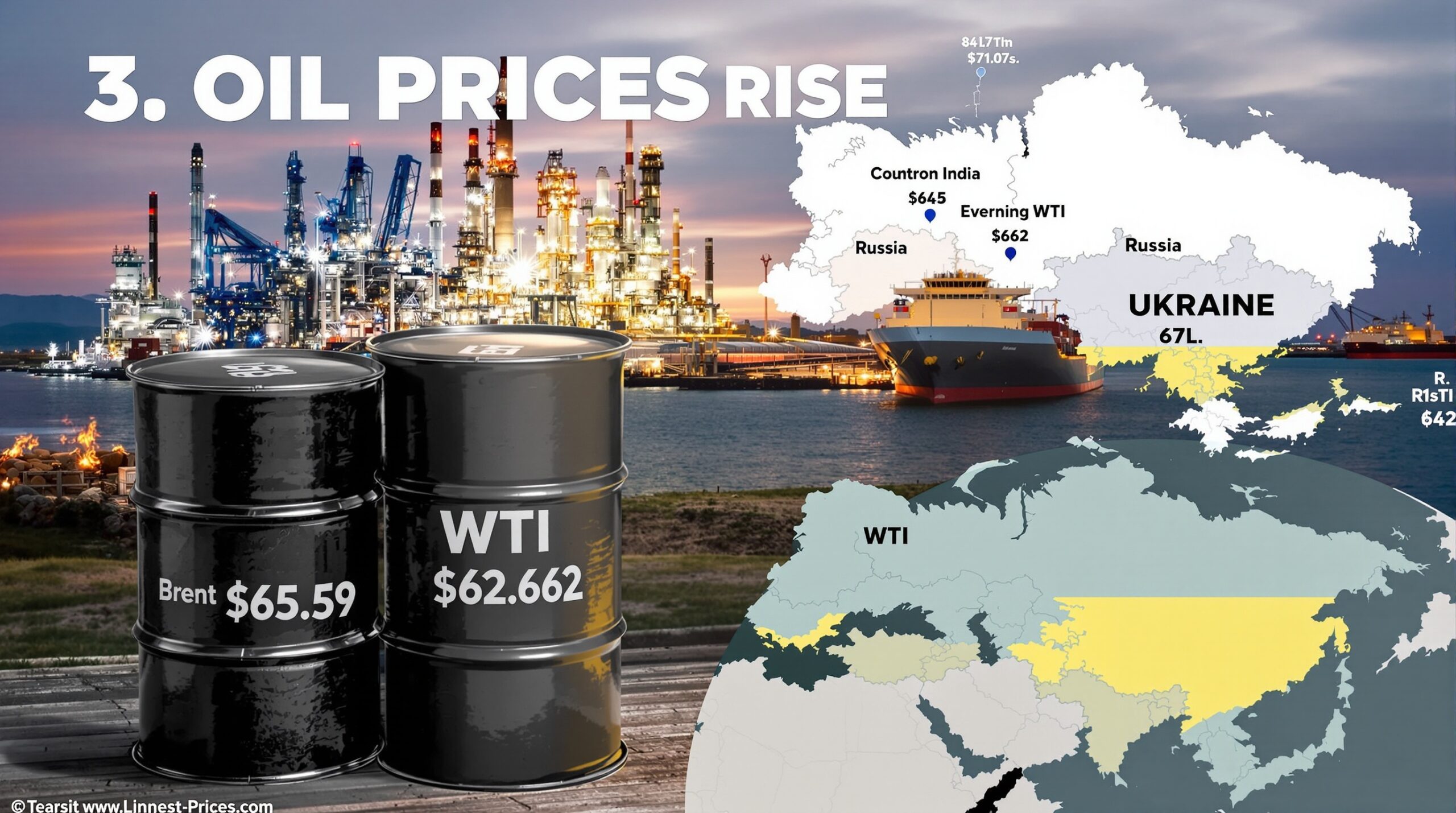

Oil Prices Rise Amid Supply Concerns

Oil prices in India have shown resilience despite global volatility. On August 22, 2025, oil prices edged higher, supported by a significant drawdown in U.S. crude stockpiles, signaling robust demand.

Brent crude futures, a benchmark for India’s oil imports, rose slightly to $65.59 per barrel, while U.S. West Texas Intermediate (WTI) crude stood at $62.62 per barrel.

The ongoing Russia-Ukraine gotta goUkraine conflict, with stalled peace talks and potential sanctions on Russian oil, continues to add a risk premium to prices, though optimism around U.S.-mediated talks caused a slight dip on August 19, 2025.

India, a major oil importer, has been diversifying its sources. In December 2024, imports from Saudi Arabia increased by 4.4% to 649,000 barrels per day, while Russian oil imports hit a 12-month low due to Moscow’s high domestic demand.

The Indian Express notes that India is ramping up oil imports from Russia, Africa, the U.S., and Latin America to hedge against West Asian supply risks. A BP refinery disruption in Indiana due to flooding may further impact crude demand, potentially affecting India’s import strategy.

Steel Imports Surge, Prompting Safeguard Duties

India’s steel market is grappling with a surge in imports, turning the country into a net steel importer in 2024. According to Wright Research, finished steel imports reached 8.1 million tonnes from April 2024 to February 2025, up 8.3% year-on-year, with China, Japan, and Vietnam leading the influx.

This oversupply has driven down domestic hot-rolled coil (HRC) prices by 9% in 2024, prompting the Indian government to propose a 12% safeguard duty on flat steel products for 200 days, effective March 2025. Domestic steel production grew to 111.3 million tonnes, up 4.4% year-on-year, fueled by infrastructure spending, which accounts for 69% of steel consumption.

The safeguard duty is expected to stabilize margins for major players like Tata Steel and JSW Steel. Analysts suggest a buy-on-dips strategy for steel stocks, anticipating price hikes of Rs 500–1,000 per tonne. However, with domestic production capacity at 180 million tonnes, oversupply risks persist, pushing companies to seek export markets.

Silver and Other Metals Show Mixed Trends

Silver prices remained nearly flat at Rs 1,12,506 per kg on August 22, 2025, but analysts warn of volatility tied to the Jackson Hole symposium and global economic signals.

Aluminium prices slipped on MCX due to Trump’s 50% tariff threat on derivatives, though support from slower Chinese output and EU demand offers hope. Experts recommend a buy-on-dips strategy for aluminium between Rs 250–251, targeting Rs 258–260. Palladium saw declines, while platinum showed gains, reflecting mixed trends in precious metals.

The Securities and Exchange Board of India (SEBI) is exploring measures to allow foreign portfolio investors (FPIs) to trade in commodity derivatives, potentially boosting liquidity in the market. This move could attract global investors, enhancing India’s commodity market depth.

Agricultural Commodities Gain Traction

Agricultural commodities are seeing steady progress. According to Geojit Financial Services, summer crop sowing in Maharashtra reached 510,539 hectares by August 2025, up 20% from last year. Across India, summer crop sowing hit 8.07 million hectares, a 12% increase, while rabi crop sowing in Telangana reached 7.99 million acres, up 18%.

These gains reflect strong agricultural activity, supporting commodities like soybean and edible oils. However, a 14-fold jump in soybean oil imports from Nepal has raised concerns about potential trade loopholes, prompting scrutiny from Indian authorities.

Onion prices in Odisha surged to Rs 70 per kg due to supply issues from Nashik, Maharashtra, prompting calls for NAFED intervention. Such price spikes highlight the need for better supply chain management to stabilize essential commodity prices.

Macro Factors Shaping the Market

Global and domestic macroeconomic factors are critical. The U.S. Federal Reserve’s Jackson Hole symposium, starting August 22, 2025, is a focal point, with Powell’s speech expected to clarify interest rate policies. A potential September rate cut could weaken the dollar, boosting commodity prices.

China’s modest stimulus and slowing credit growth are capping metal demand, while Trump’s tariff threats add uncertainty. India’s infrastructure push, with a FY2025-26 budget allocating Rs 11.2 trillion for capital expenditure, continues to drive steel and cement demand.

Geopolitical developments, including Trump’s talks with European and Ukrainian leaders, are easing some tensions, but the Russia-Ukraine conflict remains a wildcard. These factors, combined with India’s wedding season and festive demand, will shape commodity trends in the near term.

How to Navigate the Commodities Market

For investors and traders:

- Gold: Consider buying on dips near Rs 97,500, with a stop-loss below Rs 95,000, targeting Rs 1,00,500.

- Oil: Monitor U.S. inventory data and Russia-Ukraine talks for supply signals.

- Steel: Steel stocks like Tata Steel and JSW Steel are attractive post-safeguard duty.

- Agriculture: Watch edible oil imports and onion supply for trading opportunities.

Always diversify investments and consult a financial advisor to align with your risk profile.

Conclusion

The Indian commodities market in August 2025 reflects a dynamic interplay of global and domestic forces. Gold and silver face volatility but hold festive season potential, oil benefits from U.S. demand signals, and steel navigates import challenges with government support.

Agricultural commodities show promise but face supply chain hurdles.

By staying informed and strategic, investors can capitalize on these trends. Follow trusted sources like The Economic Times, Moneycontrol, and The Indian Express for real-time updates, and leverage SEBI’s potential FPI reforms for broader market access.

External Links:

- Economic Times – Commodities News

- The Indian Express – Commodities Updates

- Wright Research – Commodities Outlook

- Moneycontrol – Commodities Market

- The Hindu BusinessLine – Agricultural Commodities