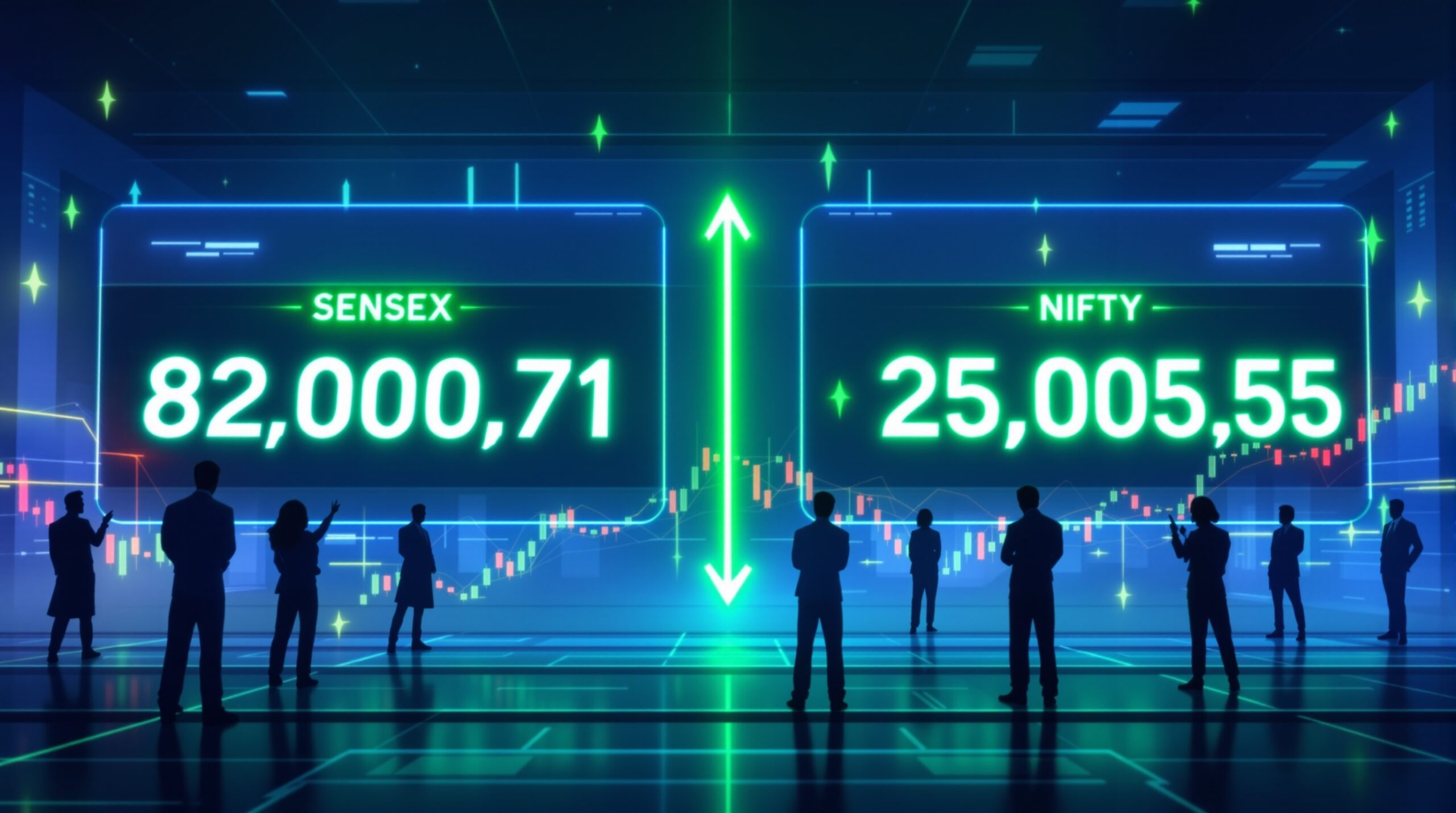

India Stock Market News Today: Sensex Closes at 82,000 Amid GST Reforms and Sector Shifts (August 21, 2025)

India Stock Market News Today

Introduction

Investors across India witnessed another positive session in the stock market today, August 21, 2025, as benchmark indices extended their winning streak to six consecutive days. The BSE Sensex climbed 143 points to close at 82,000.71, while the NSE Nifty 50 settled above the 25,000 mark at 25,050.55.

This upward momentum reflects growing confidence amid discussions on GST rate overhauls, robust economic projections, and selective sector gains.

As a professional content writer focusing on financial news for Indian audiences, I dive into the key highlights, analyzing what drove the market and what lies ahead. External links to reliable sources like Moneycontrol and Business Standard provide deeper dives into live updates.

The market opened on a strong note, with Sensex crossing 82,200 in early trade before moderating due to profit booking in certain sectors.

Traders attribute this resilience to positive domestic cues, including a parliamentary panel’s GST recommendations and optimism around India’s capital market reaching a $5 trillion valuation.

With over 200 million demat accounts now active, retail participation continues to fuel growth, though regulators eye measures to curb speculative trading.

Market Overview

Benchmark indices maintained their upward trajectory today, defying mixed global signals. The Sensex gained 142.97 points, or 0.17%, marking its sixth straight win, while Nifty rose 69.90 points, or 0.28%. Broader markets

showed mixed performance: the Nifty Midcap 100 dipped slightly, but the Nifty Smallcap index held firm against slowdown pressures.

Trading volumes remained healthy, with advances outnumbering declines on the BSE. Investors focused on pharma and banking stocks, while auto and FMCG sectors faced headwinds from proposed tax changes.

The India VIX, a measure of market volatility, eased marginally, signaling reduced fear among participants. For real-time charts and data, refer to the NSE India official website.

This performance aligns with broader economic indicators. A recent SBI report projects India’s GDP growth at 7% for the first quarter of FY26, surpassing the RBI’s estimate.

Such forecasts bolster investor sentiment, especially as foreign institutional investors (FIIs) turned net buyers today, infusing fresh capital amid concerns over US tariffs and outflows.

Top Gainers and Losers

Several stocks stole the spotlight today with impressive gains and notable declines. IDBI Bank surged 8% following updates on its divestment process, where due diligence by qualified bidders nears completion, as stated by DIPAM Secretary.

This news propelled banking stocks higher, with ICICI Bank contributing significantly to Sensex’s rise.

Other top gainers included Godawari Power and Ispat, Amara Raja Energy & Mobility, and HDFC Life, recommended by analysts for their strong fundamentals.

Railtel and Clean Science also featured prominently in stocks to watch, driven by positive order wins and earnings outlooks.

On the flip side, auto giants like those in the luxury segment faced pressure from GST panel proposals to tax high-end cars at 40%.

FMCG stocks dipped amid broader tax slab revisions, with losers including select names from the sector. For a complete list of gainers and losers, check Moneycontrol’s dedicated page.

Ex-dividend stocks added intrigue today. Coal India, RVNL, HAL, Thomas Cook, and Honda India Power traded ex-dividend, attracting dividend hunters.

These moves underscore the importance of tracking corporate actions for portfolio strategies.

Sector Performance

Pharma emerged as the star performer, lifting indices with gains in key players. Analysts attribute this to export growth and favorable policy tailwinds.

Conversely, auto and FMCG sectors lagged, impacted by GST overhaul talks that propose scrapping 12% and 28% slabs.

The Group of Ministers (GoM) accepted the Centre’s proposal, potentially streamlining taxes but raising costs for certain goods.

Banking and financial services held steady, buoyed by IDBI’s rally and BharatPe’s executive appointments ahead of a potential IPO.

IT stocks like Infosys remained watchful amid global cues, while metals showed resilience on commodity price upticks.

The tobacco sector drew attention with India ranking as the world’s second-largest consumer, projecting a ₹6 lakh crore market by 2032. This highlights untapped opportunities but also health concerns. For sector-specific indices, visit BSE India’s sector page.

Key News and Developments

Today’s market buzz centered on regulatory and policy shifts. SEBI mulls additional steps to cool the options market and reduce retail investor losses, including extending equity derivatives expiry tenures. A consultation paper is expected soon, potentially impacting trading volumes by 40-50% if weekly expiries end.

GST reforms took center stage, with the panel recommending a rationalized structure that could overhaul rates for goods and services. This includes higher taxes on luxury items, affecting auto stocks negatively. Meanwhile, the Online Gaming Bill passed Rajya Sabha, banning real-money games and possibly redirecting funds to stock markets. Market expert Sharad Kohli noted this could boost equities as gamers switch platforms.

In fintech, BharatPe strengthened its leadership for FY25 profitability and IPO preparations. Broader news included a parliamentary push for reservations in private higher education, proposing 27% for OBCs, 15% for SCs, and 7.5% for STs. Such policies could influence education stocks long-term.

India’s capital markets hit a milestone with a $5 trillion valuation, driven by surging demat accounts. For in-depth analysis, explore Reuters’ coverage.

Expert Opinions

Experts remain cautiously optimistic. Harshubh Mahesh Shah advises watching August 21-22 for potential trend shifts, noting Nifty’s reversal above 24,600. Poll data suggests modest gains ahead, clouded by US tariffs and foreign outflows.

CNBC TV18’s Bazaar show highlighted comprehensive market insights, emphasizing consolidation between 24,900-25,200. Analysts recommend focusing on quality stocks like those in pharma and banking for sustained growth.

Global Influences

Global markets presented a mixed bag. Wall Street’s S&P 500 dipped 0.26%, while Asia saw gains in Taiwan’s Taiex (1.2%) and marginal upticks in India’s peers. US tariff concerns loom, but positive cues from Gift Nifty futures supported early gains.

Currency movements influenced sentiment, with the rupee steady against the dollar. Commodity prices, including oil, remained stable, aiding energy stocks. Track global indices via Yahoo Finance.

Outlook for Tomorrow

Looking ahead to August 22, 2025, markets may consolidate amid upcoming economic data releases and Jackson Hole symposium insights. Nifty eyes 25,250 as resistance, with support at 24,900. Traders should monitor GST developments and SEBI announcements closely.

In summary, today’s session underscores India’s resilient economy, with policy reforms paving the way for sustainable growth. Investors, stay informed and diversify to navigate volatility.