NSE and BSE News Today: Market Updates on August 16, 2025

NSE and BSE News Today

Introduction: A Bullish Day for Indian Markets

On August 16, 2025, the Indian stock markets delivered a stellar performance, with the BSE Sensex climbing 1,331 points to close at 80,436.84 and the NSE Nifty50 advancing 397.40 points to settle at 24,541.15.

This robust rally, fueled by broad-based buying across sectors like IT, auto, banking, media, and realty, marked a significant rebound after a volatile week.

Investors worldwide, particularly in India, are keenly watching these developments as the markets navigate global economic cues, corporate earnings, and geopolitical uncertainties. This article dives into the day’s highlights, key performers, sectoral trends, and expert insights to keep you informed about the NSE and BSE market updates for August 16, 2025.

Market Overview: Sensex and Nifty Surge Over 1.6%

The Indian equity markets closed the week on a high note, with the BSE Sensex gaining 1.68% and the NSE Nifty50 rising 1.65%. According to Business Standard, the rally was driven by strong performances across all sectoral indices, with Nifty IT, Auto, Media, and Realty indices gaining over 2% each. The broader market also participated, with the Nifty Midcap 100 and Nifty Smallcap 100 indices advancing 1.96% and 1.93%, respectively.

The India VIX, a measure of market volatility, dropped 6.18% to 14.40, signaling reduced investor anxiety.

This upbeat session followed a holiday on August 15, 2025, for India’s 78th Independence Day, which kept the BSE and NSE closed. The positive momentum on August 16 was bolstered by favorable global cues, including a decline in US CPI inflation and optimism around US-India trade negotiations, despite earlier concerns over proposed US tariffs.

Key Gainers and Losers: Who Led the Rally?

Top Gainers

The Nifty50 saw 47 of its 50 constituents close in the green, showcasing broad-based strength. Leading the charge were:

- Wipro: Up 4.23%, driven by strong IT sector sentiment and positive Q1FY26 earnings.

- Tech Mahindra: Gained 3.94%, buoyed by optimism in IT stocks amid softer US inflation data.

- Mahindra & Mahindra: Rose significantly, supported by robust auto sector demand and festive season expectations.

- Tata Motors: Advanced notably, despite a 63% YoY Q1 profit decline, as investors focused on cost-cutting measures and EV margin improvements.

- Grasim: Emerged as a top performer, reflecting strength in diversified sectors.

On the BSE Sensex, 29 of 30 constituents ended higher, with Tech Mahindra, Mahindra & Mahindra, Tata Motors, UltraTech Cement, and TCS leading gains.

Top Losers

While the market was overwhelmingly positive, a few stocks lagged:

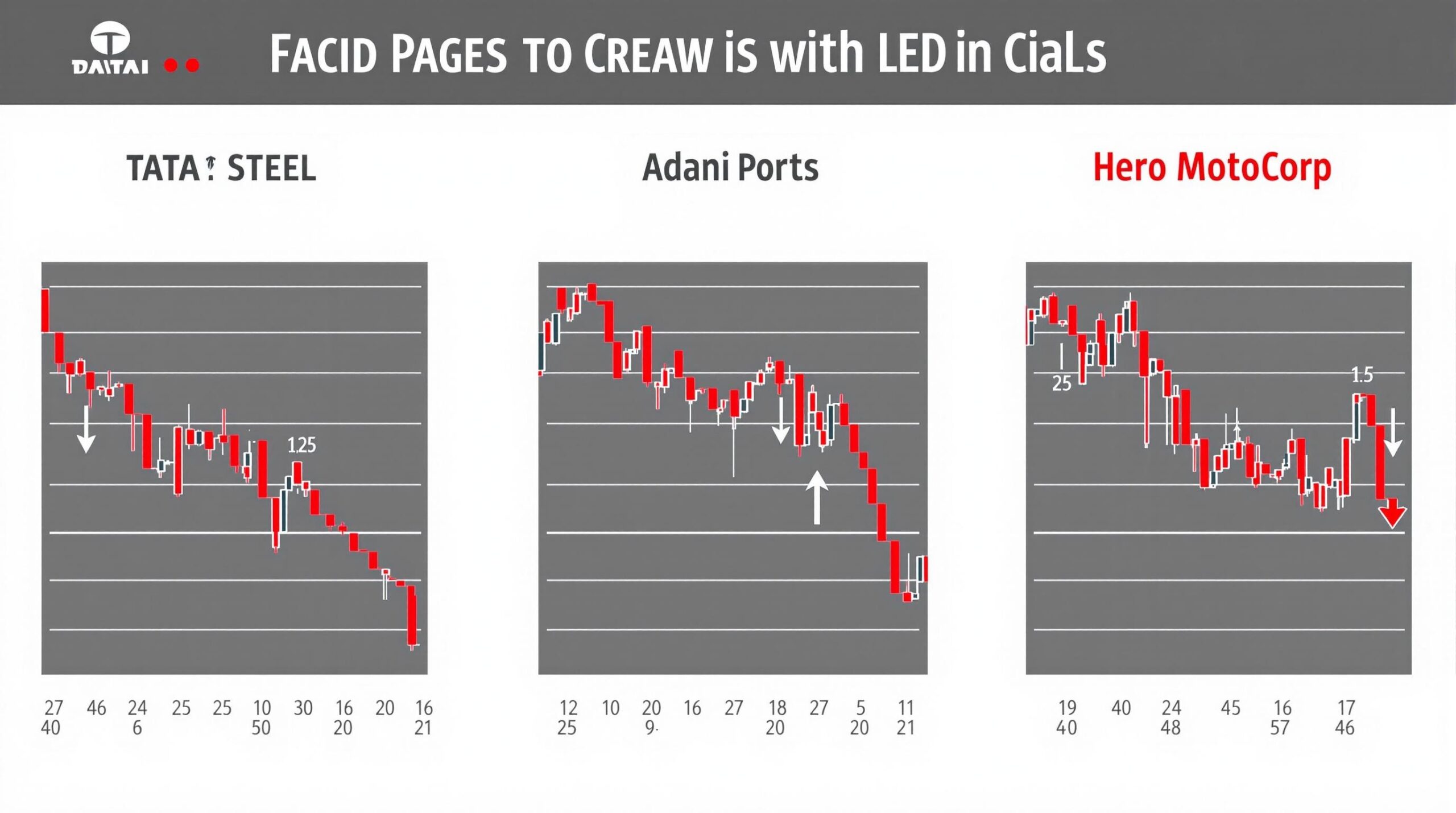

- Tata Steel: Declined due to falling commodity prices and oversupply concerns in the metal sector.

- Adani Ports: Faced selling pressure, reflecting cautious investor sentiment in select large caps.

- Hero MotoCorp: Ended lower, impacted by weaker mass consumption trends.

Sectoral Performance: IT, Auto, and Banking Shine

The Nifty IT index surged 3%, driven by strong buying in stocks like Wipro, TCS, and Infosys.

This rally was fueled by positive US economic data, including a decline in CPI inflation, which boosted confidence in IT firms with significant US revenue exposure. The auto sector also performed strongly, with the Nifty Auto index up 2%, led by Mahindra & Mahindra and Tata Motors. Expectations of festive season demand and cost-cutting measures supported the sector’s gains.

The Nifty Bank index rebounded impressively, gaining 0.27% to close at 56,300 after a 1.4% recovery from intraday lows. ICICI Bank and Kotak Mahindra Bank were key contributors, shrugging off earlier concerns about US tariffs.

The realty and media sectors also saw gains exceeding 2%, reflecting optimism in domestic consumption and urban expansion.

Conversely, sectors like metals and energy faced headwinds due to declining commodity prices and global oversupply concerns, as noted by Vinod Nair, Head of Research at Geojit Investments.

Global Market Context: A Mixed Bag

Global markets provided a mixed backdrop for India’s rally. In the US, S&P 500 and Nasdaq futures remained flat, while the Dow Jones Industrial Average saw marginal declines. European markets, tracked by the Stoxx Europe 600, rose 0.2%, indicating cautious optimism.

Asian markets showed resilience, with Hong Kong’s Hang Seng and Australia’s ASX 200 rallying over 1%, though Japan’s Nikkei 225 dipped 0.4%.

The global sentiment was influenced by US retail sales data and declining jobless claims, which alleviated recession fears.

However, concerns over US tariffs, particularly President Trump’s proposed 25% tariffs on Indian goods, lingered. Optimism around ongoing US-India trade talks and a dip in Brent crude prices to $73.10 per barrel provided some relief for Indian markets, given India’s status as a major oil importer.

Corporate Highlights and Q1 Earnings

Several companies made headlines with their Q1FY26 earnings and strategic announcements:

- Tata Motors: Reported a 63% YoY decline in consolidated profit but highlighted improving EV margins and cost-cutting initiatives, boosting investor confidence .

- Vodafone Idea: Saw its Q1 ARPU rise to ₹177, up 15% YoY, though net losses widened to ₹6,608 crore .

- Inox Wind: Posted a doubled net profit of ₹97.34 crore, driven by higher revenues .

- Nuvama Wealth Management: Reported a 19% rise in Q1 PAT to ₹264 crore, with revenues up 15% .

- Adani Group: Ambuja Cements completed its acquisition of Penna Cement, strengthening its southern India presence .

These earnings underscored a mixed corporate performance, with IT and select financials showing resilience, while sectors like auto faced challenges from sluggish domestic demand.

Expert Insights: What’s Driving the Market?

Market experts provided valuable perspectives on the day’s movements:

- Rupak De, Senior Technical Analyst, LKP Securities: Noted that the Nifty rallied above 24,500 but may consolidate within the 24,300–24,550 range in the near term. A decisive move above 24,550 could trigger further upside .

- Vinod Nair, Head of Research, Geojit Investments: Highlighted that Indian IT firms benefited from strong US economic data and declining CPI inflation. However, weak Q1 earnings and FII selling (₹3,644.43 crore on August 13) limited broader gains .

- VK Vijayakumar, Chief Investment Strategist, Geojit Investments: Pointed out that FIIs have been net sellers due to elevated Indian valuations and global tariff concerns, but domestic institutional buying (₹5,623.79 crore on August 13) supported the market .

Analysts also noted S&P’s upgrade of India’s credit rating, citing policy continuity and infrastructure-led growth, as a positive long-term driver for Indian equities.

IPO and Investment Opportunities

The IPO market remained active, with several offerings drawing attention:

- Saraswati Saree Depot: Set to list on August 20, 2025, with a grey market premium (GMP) of ₹48, indicating a potential 30% listing gain .

- Regaal Resources IPO: Closed with a subscription of 159.88 times and a GMP of 24%, signaling strong investor interest .

- Studio LSD IPO: Scheduled to open on August 18, aiming to raise ₹74.25 crore .

Investors are advised to monitor these IPOs closely, as they reflect growing confidence in India’s SME and retail sectors.

Looking Ahead: Key Triggers for the Market

As the markets move forward, several factors will shape their trajectory: 1ස

- US-India Trade Talks: Ongoing negotiations could mitigate tariff concerns, potentially boosting market sentiment.

- Q1 Earnings: Upcoming results from companies like ONGC, IRCTC, and Hindalco (week of August 11) will influence stock-specific movements .

- Global Economic Data: US retail sales, jobless claims, and inflation trends will continue to impact IT and export-driven sectors.

- Festive Season Demand: Auto and consumer durable stocks may see sustained interest as India’s festive season approaches.

For investors, experts like Nischal Maheshwari recommend an 80:20 investment strategy, focusing 80% on domestic sectors like banking, telecom, and capital goods, and 20% on resilient global plays like IT and pharma .

This approach balances domestic growth with global exposure, especially amid tariff uncertainties.

Conclusion: A Promising Outlook for Indian Markets

The NSE and BSE markets showcased resilience on August 16, 2025, with the Sensex and Nifty posting strong gains amid positive global cues and domestic optimism. IT, auto, and banking sectors led the rally, supported by declining volatility and robust DII buying.

While challenges like FII selling and global tariff concerns persist, India’s strong economic fundamentals, as highlighted by S&P’s rating upgrade, provide a solid foundation for growth. Investors should stay vigilant, focusing on high-quality stocks in banking, IT, and select midcaps, while monitoring upcoming earnings and trade developments.

Stay tuned to Business Standard and Economic Times for real-time market updates, and explore investment opportunities in IPOs and domestic-focused sectors to capitalize on India’s growth story.