10 Essential Personal Finance Tips for Everyone to Build Wealth and Security

Personal Finance Tips

Why Personal Finance Matters for Everyone

Financial literacy empowers you to make informed decisions, avoid debt traps, and build wealth over time.

According to a 2023 study by the National Financial Educators Council, 65% of Americans feel stressed about money, yet only 17% have a solid financial plan.

These personal finance tips bridge that gap, offering universal strategies to improve your financial health, regardless of your income or experience level.

Primary Keyword: Personal Finance Tips

Secondary Keywords: Financial Freedom, Budgeting Tips, Saving Money, Investing for Beginners

1. Create a Realistic Budget and Stick to It

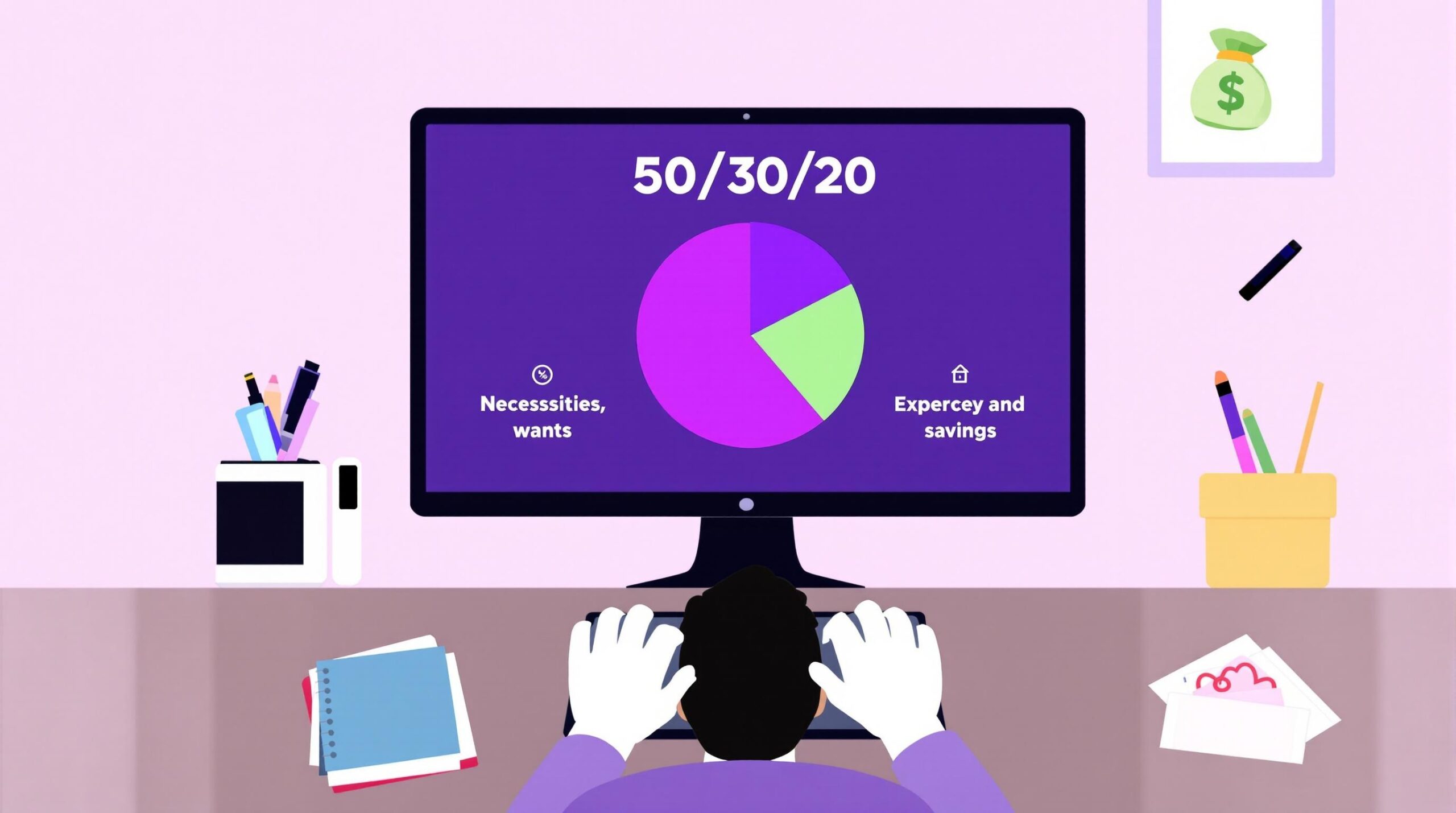

A budget is your financial roadmap. The 50/30/20 rule is a popular budgeting method: allocate 50% of your income to necessities (housing, utilities), 30% to wants (dining out, hobbies), and 20% to savings or debt repayment.

Use apps like Mint or YNAB to track spending in real-time. Review your budget monthly to adjust for changes in income or expenses.

Pro Tip: Automate bill payments to avoid late fees and ensure consistency.

2. Build an Emergency Fund for Unexpected Expenses

Life is unpredictable, and an emergency fund acts as a financial safety net.

Aim to save 3-6 months’ worth of living expenses in a high-yield savings account, like those offered by Ally Bank or Marcus by Goldman Sachs.

Start small—$500 can cover minor emergencies—and contribute regularly.

Why It Matters: A Federal Reserve report found 37% of Americans can’t cover a $400 emergency without borrowing.

3. Pay Off High-Interest Debt First

High-interest debt, like credit card balances, can derail your financial goals. Use the avalanche method: prioritize debts with the highest interest rates while making minimum payments on others.

For example, if you have a credit card with 18% APR and a student loan at 5%, focus on the card first. Tools like Undebt.it can help you create a repayment plan.

Action Step: Contact creditors to negotiate lower interest rates or explore balance transfer cards with 0% introductory APR.

4. Start Investing Early for Long-Term Growth

Investing is key to building wealth. Even small amounts invested early can grow significantly due to compound interest.

For beginners, consider low-cost index funds or ETFs through platforms like Vanguard or Fidelity.

A $100 monthly investment in an S&P 500 index fund with an average 7% annual return could grow to over $150,000 in 30 years.

Beginner Tip: Open a Roth IRA for tax-free growth if you’re eligible. Learn more at IRS.gov.

5. Understand Your Credit Score and Improve It

Your credit score impacts loan rates, apartment approvals, and even job applications.

Check your score for free on platforms like Credit Karma or Experian. To improve your score:

- Pay bills on time (35% of your score).

- Keep credit card balances below 30% of your limit (30% of your score).

- Avoid opening too many accounts in a short period.

Fun Fact: A good credit score (670-739) can save you thousands on mortgage interest compared to a poor score.

6. Save for Retirement Now, No Matter Your Age

Retirement may seem distant, but starting early maximizes your savings. Contribute to employer-sponsored plans like a 401(k), especially if they offer matching contributions.

For example, if your employer matches 5% of your salary, that’s free money! Self-employed? Consider a SEP IRA. Aim to save 15% of your income annually for retirement.

Resource: Use Bankrate’s retirement calculator to estimate your needs.

7. Protect Yourself with the Right Insurance

Insurance safeguards your finances against unexpected events. At a minimum, consider:

- Health Insurance: Covers medical expenses to avoid crippling bills.

- Auto/Homeowners/Renters Insurance: Protects your assets from damage or theft.

- Life Insurance: Ensures your family’s financial security if you pass away. Explore term life options at Policygenius.

Quick Tip: Bundle policies (e.g., auto and home) for discounts.

8. Diversify Your Income Streams

Relying on a single income source is risky. Explore side hustles like freelance writing, online tutoring, or selling digital products on platforms like Etsy or Fiverr.

Passive income, such as rental properties or dividend-paying stocks, can also boost financial stability.

Inspiration: A 2024 survey by Upwork shows 38% of Americans have a side hustle, averaging $1,000 extra monthly.

9. Educate Yourself on Financial Literacy

Knowledge is power. Read books like The Millionaire Next Door by Thomas J. Stanley or Your Money or Your Life by Vicki Robin.

Follow reputable financial blogs like The Motley Fool or Money Under 30. Free courses on Coursera or edX can also deepen your understanding.

Action Step: Dedicate 10 minutes daily to learning one new financial concept.

10. Set Clear Financial Goals and Review Them

Goals give your finances direction. Whether it’s buying a home, starting a business, or traveling, define specific, measurable, and time-bound goals.

For example: “Save $10,000 for a home down payment in 2 years.” Break goals into monthly targets and track progress using apps like Tiller Money.

Motivation: Write down your goals—studies show written goals are 42% more likely to be achieved (Harvard Business Review).

Bonus Tip: Automate Your Finances for Success

Automation simplifies money management. Set up:

- Automatic Savings Transfers: Move money to savings accounts on payday.

- Bill Payments: Avoid late fees with auto-pay.

- Investment Contributions: Regularly invest in your 401(k) or IRA.

Tools like Chime or Acorns make automation seamless.

Conclusion: Take Control of Your Financial Future

Mastering personal finance is a journey, not a race. By implementing these 10 personal finance tips, you’ll build a strong foundation for financial freedom.

Start with one or two tips—like creating a budget or building an emergency fund—and gradually incorporate others. Your future self will thank you.

Call to Action: What’s your first step toward financial freedom? Share your goals in the comments or start today with a budgeting app like Mint.

For more personalized advice, consult a financial advisor or explore resources at Consumer Financial Protection Bureau.